Results of ARRA-Funded CER Dissemination Activities

Contents

Slide 1. High-Level Data Analysis Presentation Slide Deck

Slide 2. Overview

Slide 3. Quarterly Metrics

Slide 4. Quarterly Metrics

Slide 5. Cumulative Exposures by Dissemination Strategy

Slide 6. Cumulative Exposures from All Strategies by Audience

Slide 7. Academic Detailing

Slide 8. Continuing Education

Slide 9. Media and Marketing

Slide 10. Dissemination Partnerships

Slide 11. Virtual Centers

Slide 12. Continuing Education Retention Test Analysis

Slide 13. Continuing Education Retention Tests

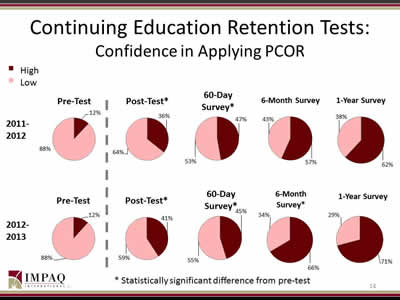

Slide 14. Continuing Education Retention Tests: Confidence in Applying PCOR

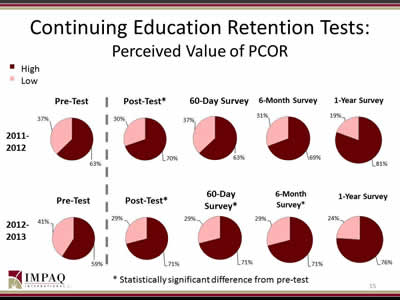

Slide 15. Continuing Education Retention Tests: Perceived Value of PCOR

Slide 16. Web and Clearinghouse Reports

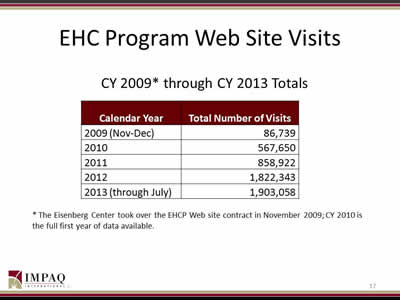

Slide 17. EHC Program Web Site Visits

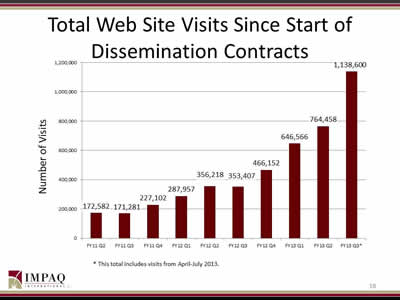

Slide 18. Total Web Site Visits Since Start of Dissemination Contracts

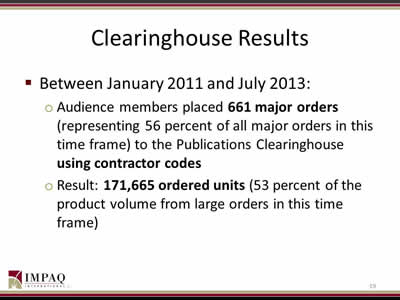

Slide 19. Clearinghouse Results

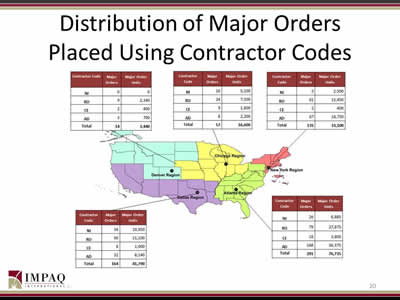

Slide 20. Distribution of Major Orders Placed Using Contractor Codes

Slide 21. Consumer and Clinician Surveys

Slide 22. Surveys: Background

Slide 23. Consumer Survey Findings (Wave 1 )

Slide 24. Consumer Survey Findings (Wave 2)

Slide 25. Consumer Survey Findings (Longitudinal)

Slide 26. Consumer Survey Findings (Longitudinal con't)

Slide 27. Clinician Surveys

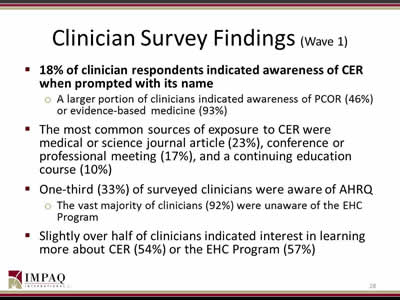

Slide 28. Clinician Survey Findings (Wave 1)

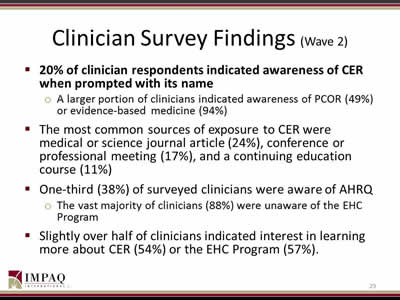

Slide 29. Clinician Survey Findings (Wave 2)

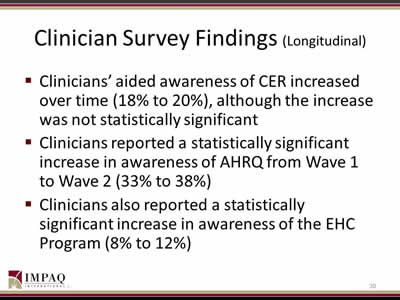

Slide 30. Clinician Survey Findings (Longitudinal)

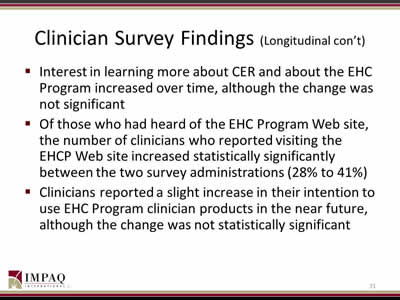

Slide 31. Clinician Survey Findings (Longitudinal con't)

Slide 32. Focus Groups

Slide 33. Focus Groups

Slide 34. Consumer Focus Group Findings

Slide 35. Clinician Focus Group Findings

Slide 36. Business Leader Findings

Slide 37. Summary

Slide 1: High-Level Data Analysis Presentation Slide Deck

October 15, 2013

Sari Siegel, Ph.D.

Project Director

ARRA CER Dissemination Evaluation

Slide 2: Overview

- Quarterly Metrics.

- Continuing Education Retention Test Analysis.

- Web and Clearinghouse Report.

- Survey:

- Consumer.

- Clinician.

- Focus Groups:

- Consumer.

- Clinician.

- Business.

- Leader/Purchaser.

- Summary.

Slide 3: Quarterly Metrics

Reach and Dissemination

Slide 4: Quarterly Metrics

- As part of the ARRA CER Dissemination Evaluation, IMPAQ/Battelle collects:

- Quarterly metrics on dissemination activities and audience exposure to PCOR from the four dissemination contractors (Academic Detailing, Continuing Education, National Initiative, and Regional Offices).

- Quarterly data on EHC Program Web site traffic and AHRQ Publications Clearinghouse orders.

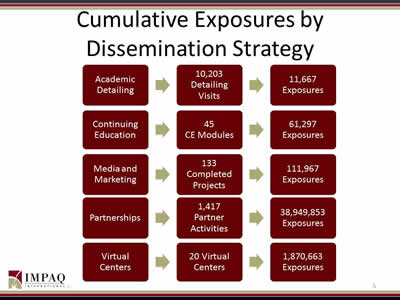

Slide 5: Cumulative Exposures by Dissemination Strategy

Image: A series of text boxes connected by arrows show dissemination activities and resulting exposures across the different strategies:

Academic Detailing → 10,203 Detailing Visits → 11,667 Exposures

Continuing Education → 45 CE Modules → 61,297 Exposures

Media and Marketing → 133 Completed Projects → 111,967 Exposures

Partnerships → 1,417 Partner Activities → 38,949,853 Exposures

Virtual Centers → 20 Virtual Centers → 1,870,663 Exposures

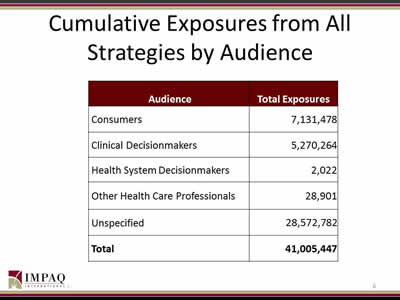

Slide 6: Cumulative Exposures from All Strategies by Audience

| Audience | Total Exposures |

|---|---|

| Consumers | 7,131,478 |

| Clinical Decisionmakers | 5,270,264 |

| Health Systems Decisionmakers | 2,022 |

| Other Health Care Professionals | 28,901 |

| Unspecified | 28,572,782 |

| Total | 41,005,447 |

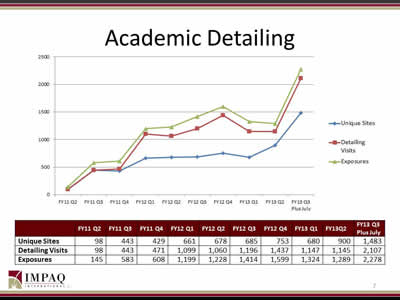

Slide 7: Academic Detailing

Image: This line graph shows "snapshots" of the Academic Detailing activities as reported each quarter through the final data collection period of this contract. The values are presented in the table below.

| FY11 Q2 | FY11 Q3 | FY11 Q4 | FY12 Q1 | FY12 Q2 | FY12 Q3 | FY12 Q4 | FY13 Q1 | FY13 Q2 | FY13 Q3 Plus July | |

|---|---|---|---|---|---|---|---|---|---|---|

| Unique Sites | 98 | 443 | 429 | 661 | 678 | 685 | 753 | 680 | 900 | 1,483 |

| Detailing Visits | 98 | 443 | 471 | 1,099 | 1,060 | 1,196 | 1,437 | 1,147 | 1,145 | 2,107 |

| Exposures | 145 | 583 | 608 | 1,199 | 1,228 | 1,414 | 1,599 | 1,324 | 1,289 | 2,278 |

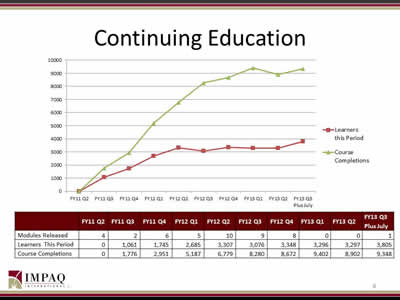

Slide 8: Continuing Education

Image: This line graph shows "snapshots" of Continuing Education activities as reported each quarter through the final data collection period of this contract. The values are presented in the table below.

| FY11 Q2 | FY11 Q3 | FY11 Q4 | FY12 Q1 | FY12 Q2 | FY12 Q3 | FY12 Q4 | FY13 Q1 | FY13 Q2 | FY13 Q3 Plus July | |

|---|---|---|---|---|---|---|---|---|---|---|

| Modules Released | 4 | 2 | 6 | 5 | 10 | 9 | 8 | 0 | 0 | 1 |

| Learners This Period | 0 | 1,061 | 1,745 | 2,685 | 3,307 | 3,076 | 3,348 | 3,296 | 3,297 | 3,805 |

| Course Completions | 0 | 1,776 | 2,951 | 5,187 | 6,779 | 8,280 | 8,672 | 9,402 | 8,902 | 9,348 |

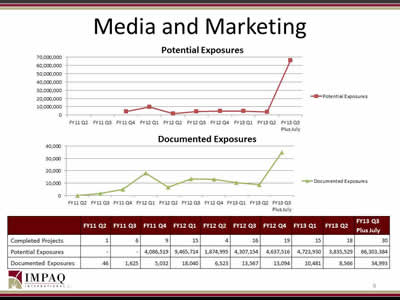

Slide 9: Media and Marketing

Image: Two line graphs show "snapshots" of media and marketing activities as reported each quarter through the final data collection period of this contract. The values are presented in the table below.

| FY11 Q2 | FY11 Q3 | FY11 Q4 | FY12 Q1 | FY12 Q2 | FY12 Q3 | FY12 Q4 | FY13 Q1 | FY13 Q2 | FY13 Q3 Plus July | |

|---|---|---|---|---|---|---|---|---|---|---|

| Completed Projects | 1 | 6 | 9 | 15 | 4 | 16 | 19 | 15 | 18 | 30 |

| Potential Exposures | - | - | 4,086,519 | 9,465,714 | 1,874,995 | 4,307,154 | 4,637,516 | 4,723,930 | 3,835,529 | 66,303,384 |

| Documented Exposures | 46 | 1,625 | 5,032 | 18,040 | 6,523 | 13,567 | 13,094 | 10,481 | 8,566 | 34,993 |

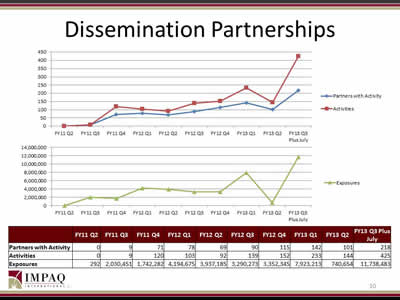

Slide 10: Dissemination Partnerships

Image: Two line graphs show "snapshots" of disseminating partnership activities as reported each quarter through the final data collection period of this contract. The values are presented in the table below.

| FY11 Q2 | FY11 Q3 | FY11 Q4 | FY12 Q1 | FY12 Q2 | FY12 Q3 | FY12 Q4 | FY13 Q1 | FY13 Q2 | FY13 Q3 Plus July | |

|---|---|---|---|---|---|---|---|---|---|---|

| Partners with Activity | 0 | 9 | 71 | 78 | 69 | 90 | 115 | 142 | 101 | 218 |

| Activities | 0 | 9 | 120 | 103 | 92 | 139 | 152 | 233 | 144 | 425 |

| Exposures | 292 | 2,030,451 | 1,742,282 | 4,194,675 | 3,937,185 | 3,290,273 | 3,352,345 | 7,923,213 | 740,654 | 11,738,483 |

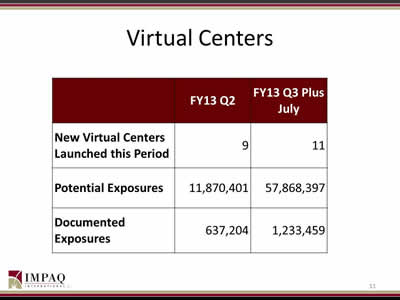

Slide 11: Virtual Centers

| Fy13 Q2 | FY | |

|---|---|---|

| New Virtual Centers Launched this Period | 9 | 11 |

| Potential Exposures | 11,870,401 | 57,868,397 |

| Documented Exposures | 637,204 | 1,233,459 |

Slide 12: Continuing Education Retention Test Analysis

Continuing Education Retention Test Analysis

Slide 13: Continuing Education Retention Tests

- Learners were generally more likely to answer content questions correctly after taking a CE module.

- More learners rated their confidence in applying PCOR as "high" after taking a module.

- More learners rated their perceived value of PCOR as "high" after taking a module.

Slide 14: Continuing Education Retention Tests: Confidence in Applying PCOR

Image: This set of pie graphs shows confidence in applying PCOR in continuing education retention tests for two periods: April 2011 through June 2012 and July 2012 through June 2013.

Slide 15: Continuing Education Retention Tests: Perceived Value of PCOR

Image: This set of pie graphs shows perceived value of PCOR in continuing education retention tests for two periods: April 2011 through June 2012 and July 2012 through June 2013. The majority of respondents rated their perceived value of PCOR as "high" before taking a module, so there were fewer respondents who could "change their mind" and move from "low" to "high" perceived value.

Slide 16: Web and Clearinghouse Reports

Web and Clearinghouse Reports

Slide 17: EHC Program Web Site Visits

CY 2009* through CY 2013 Totals

| Calendar Year | Total Number of Visits |

|---|---|

| 2009 (Nov-Dec) | 86,739 |

| 2010 | 567,650 |

| 2011 | 858,922 |

| 2012 | 1,822,343 |

| 2013 (through July) | 1,903,058 |

* The Eisenberg Center took over the EHCP Web site contract in November 2009; CY 2010 is the full first year of data available.

Slide 18: Total Web Site Visits Since Start of Dissemination Contracts

Image: This graph displays the trend in Web site visits during each of the quarterly periods since the dissemination contracts (and activities) began. The values are presented in the table below.

| Fiscal Year | Number of Visits |

|---|---|

| FY11 Q2 | 172,582 |

| FY11 Q3 | 171,281 |

| FY11 Q4 | 227,102 |

| FY12 Q1 | 287,957 |

| FY12 Q2 | 356,218 |

| FY12 Q3 | 353,407 |

| FY12 Q4 | 466,152 |

| FY13 Q1 | 646,566 |

| FY13 Q2 | 764,458 |

| FY13 Q3* | 1,138,600 |

* This total includes visits from April-July 2013.

Slide 19: Clearinghouse Results

- Between January 2011 and July 2013:

- Audience members placed 661 major orders (representing 56 percent of all major orders in this time frame) to the Publications Clearinghouse using contractor codes.

- Result: 171,665 ordered units (53 percent of the product volume from large orders in this time frame).

Slide 20: Distribution of Major Orders Placed Using Contractor Codes

Image: This slide presents a visualization of both the five regions of this CER dissemination effort, as well as the distribution of large Clearinghouse orders (200 or more units) placed using a dissemination contractor codes. The largest number of orders and the largest volume of units came from orders placed by audience members in the Atlanta area. Audience members used the Academic Detailing code most often, but ordered the largest volume of units using the Regional Offices code.

Slide 21: Consumer and Clinician Surveys

Understanding, Knowledge, Use, and Benefits

Slide 22: Surveys: Background

- Team developed one instrument for consumers and one for clinicians.

- Data collection was completed at two points in time one year apart (Wave 1 and Wave 2).

- Surveys were designed to assess:

- Levels of awareness, understanding, use, and perceived benefits of CER.

- If and how levels of awareness, understanding, use, and perceived benefits of CER have changed.

- Trends in awareness of AHRQ and its EHC Program.

Slide 23: Consumer Survey Findings (Wave 1)

- 18% of surveyed consumers reported awareness of CER when prompted with a definition.

- Of those who indicated aided awareness of CER, just over half (56%) currently use the research to help make medical decisions.

- The most common sources of information of CER were health care providers (29%), Web sites (26%), and print media (24%).

- Very few surveyed consumers had heard of AHRQ (4%) or the EHC Program (4%); just under 1% had used its products.

Slide 24: Consumer Survey Findings (Wave 2)

- 21% of surveyed consumers reported awareness of CER when prompted with a definition.

- Of those who indicated aided awareness of CER, just over half (52%) currently use the research to help make medical decisions.

- The most common sources of information of CER were printed media (21%), Web Sites (19%), television/radio (19%) and health care providers (18%).

- Very few surveyed consumers had heard of AHRQ (11%) or the EHC Program (7%); just under 3% had used its products.

Slide 25: Consumer Survey Findings (Longitudinal)

- Consumers' unaided and aided awareness of CER increased over time (61% to 65%, 18% to 21% respectively), although the increase was not statistically significant.

- Consumers reported a statistically significant increase in awareness of AHRQ from wave 1 to wave 2 (4% to 11%).

- Consumers reported an increased awareness of the EHC Program from Wave 1 to Wave 2 (4% to 7%), although this increase was not statistically significant.

Slide 26: Consumer Survey Findings (Longitudinal con't)

- Consumer interest in learning more about CER increased over time (37% to 51%) and was statistically significant.

- There was a statistically significant increase in interest in learning about the EHC Program over time (44% to 58%).

- Consumers reported an increased intention to use AHRQ's products or other studies to inform decisionmaking (39% to 45%), although the increase was not statistically significant.

Slide 27: Clinician Surveys

Understanding, Knowledge, Use, and Benefits

Slide 28: Clinician Survey Findings (Wave 1)

- 18% of clinician respondents indicated awareness of CER when prompted with its name.

- A larger portion of clinicians indicated awareness of PCOR (46%) or evidence-based medicine (93%).

- The most common sources of exposure to CER were medical or science journal article (23%), conference or professional meeting (17%), and a continuing education course (10%).

- One-third (33%) of surveyed clinicians were aware of AHRQ.

- The vast majority of clinicians (92%) were unaware of the EHC Program.

- Slightly over half of clinicians indicated interest in learning more about CER (54%) or the EHC Program (57%)

Slide 29: Clinician Survey Findings (Wave 2)

- 20% of clinician respondents indicated awareness of CER when prompted with its name.

- A larger portion of clinicians indicated awareness of PCOR (49%) or evidence-based medicine (94%).

- The most common sources of exposure to CER were medical or science journal article (24%), conference or professional meeting (17%), and a continuing education course (11%).

- One-third (38%) of surveyed clinicians were aware of AHRQ.

- The vast majority of clinicians (88%) were unaware of the EHC Program.

- Slightly over half of clinicians indicated interest in learning more about CER (54%) or the EHC Program (57%).

Slide 30: Clinician Survey Findings (Longitudinal)

- Clinicians' aided awareness of CER increased over time (18% to 20%), although the increase was not statistically significant.

- Clinicians reported a statistically significant increase in awareness of AHRQ from Wave 1 to Wave 2 (33% to 38%).

- Clinicians also reported a statistically significant increase in awareness of the EHC Program (8% to 12%).

Slide 31: Clinician Survey Findings (Longitudinal con't)

- Interest in learning more about CER and about the EHC Program increased over time, although the change was not significant.

- Of those who had heard of the EHC Program Web site, the number of clinicians who reported visiting the EHCP Web site increased statistically significantly between the two survey administrations (28% to 41%).

- Clinicians reported a slight increase in their intention to use EHC Program clinician products in the near future, although the change was not statistically significant.

Slide 32: Focus Groups

Understanding, Knowledge, Use, and Perceived Benefits

Slide 33: Focus Groups

Focus groups were conducted with the following stakeholder groups:

- Consumers/patients.

- Clinicians.

- Business Leaders/Purchaser.

Slide 34: Consumer Focus Group Findings

- A majority of participants expressed interest in CER and noted that they plan to use CER (from AHRQ and other reliable sources) to inform future medical decisions.

- Aware participants used online medical information more frequently and robustly than unaware participants to inform medical decisions.

- Unaware participants relied heavily on medical professionals for medical information and used online medical sources to supplement this information.

- To help make medical decisions, participants most frequently desired an assessment of the pros, cons, and costs of available treatment options.

- Almost all participants approved of the government's role in sponsoring CER and the EHC Program.

Slide 35: Clinician Focus Group Findings

- While clinicians rely on several information sources, they rely on those with which they have developed a comfort level and will continue to use that source, often to the exclusion of other new and potentially useful sources.

- Clinicians are cautious about biases or conflicts of interest from information sources, including commercial and government-sponsored research.

- The majority of clinicians had little to no experience with the EHC Program.

- To increase interest in the EHC Program, clinicians suggested that AHRQ more visibly promote the benefits and credibility of EHC Program-sponsored CER, and then integrate the results and products into existing, easy-to-access sources of medical information, with special emphasis on packaging to support point-of-care decisionmaking.

Slide 36: Business Leader Findings

- All participants indicated awareness either specifically of CER or generally of research that compares treatment options.

- Most focus group participants indicated awareness of AHRQ; several had heard of AHRQ's EHC Program.

- Those participants familiar with CER attributed their awareness to the ACA, AHRQ, and business-focused coalitions.

- Participants' organizations did not disseminate information on CER specifically; however, organizations did share general health care information with their employees and members.

- Participants were interested in how employers can use CER to help prepare employees make medical decisions and affect outcomes for specific diagnoses (including arthritis, obesity, diabetes, cancer, and cardiovascular conditions).

Slide 37: Summary

- The findings from our multiple data sources (dissemination contractor metrics, Web and Clearinghouse metrics, and surveys and focus groups with target audiences) indicate interest in CER/PCOR and a growing engagement with AHRQ's brand of this research.

- As the dissemination contractors increased their efforts over time, we saw corresponding increase in the number of exposures to the EHC Program. These exposures lead to measurable outcomes of engagement with EHC Program products, including the fact that the majority of large-volume Clearinghouse orders referenced a dissemination contractor code.

- Survey and focus group data show that clinicians, consumers, and business leaders are interested in CER to inform medical decisions. Similarly, these audiences have had some exposure to AHRQ's EHC Program and are interested in learning more about and engaging with EHC Program materials.