Clinician Instructions

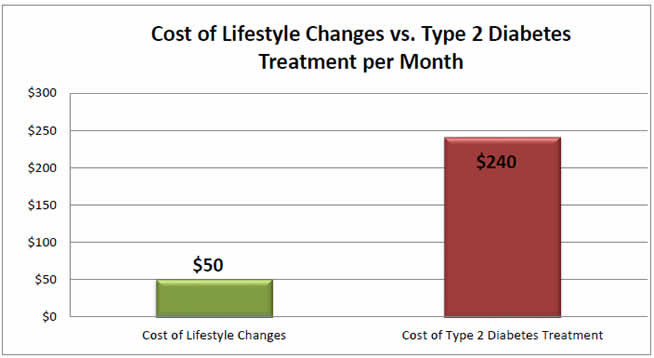

The High Cost of Diabetes is a graphic that may be useful when discussing lifestyle change with patients. We often hear that patients don't have the financial means to eat better food or exercise more. A common refrain is that they don't have money to pay for exercise equipment, new shoes, gym memberships, or fitness classes. They argue that their supermarket bill will be much higher if they start "eating healthy." It's tempting to get into debates with these patients; e.g., pointing out that high-quality, unprocessed foods like beans and whole fruits are actually cheaper than calorie-dense convenient foods or fast foods. Sometimes that approach works, but this tool is designed to shift perspectives. Because regardless of whether a patient's claim of cost barrier is legitimate or not, their perception is what matters most when they are making their decision.

That's where the Weighing the Cost graphic may be useful. This graphic is a combination of dollar figures for the actual costs a person with diabetes would incur plus the quality of life/mortality data related to diabetes. All costs were calculated in 2011, using data collected by a research intern who scoured Web sites, called pharmacies and insurance companies, spoke to several physicians (e.g., primary care physicians, endocrinologists, etc.) and looked at health economist articles. The goal was to determine the actual out-of-pocket costs to the patient, not the overall healthcare system. Costs were calculated with the assumption the patient would have employer-provided insurance or Medicare; obviously, costs will be much higher for the self-insured or uninsured patient. In order to emphasize the point, the graph was intentionally created to be as conservative as possible for the cost of diabetes and more liberal on the cost of lifestyle change.

The graph was originally developed to compare the personal costs to patients to join a YMCA Diabetes Prevention Program but the figure of $50/month is comparable to joining a wellness center or commercial weight loss group, even when accounting for things like gas money. Patients could also use the figure to think about the money they might put towards new walking shoes or healthy convenience foods like bagged salads.

- If you encounter a patient for whom finances are providing a convenient argument for the status quo, you might begin by asking the patient how much, each month, a potential lifestyle change would cost.

- If the patient's estimates are far off what you know for your area, you may have an opportunity to help them rethink their perception of costs.

Then you can have the patient imagine what it might cost if she or he develops health complications from an inactive or overweight lifestyle. You can use diabetes as an example, and bring out this graphic to help your discussion.

Weighing the Cost

| Cost of Lifestyle Change | Cost of Type 2 Diabetes |

|---|---|

| $50 per month could buy... | $240 per month Note: Costs calculated for patient with insurance or Medicare; expect higher costs for self-insured |

|

Wellness facility or gym membership

|

$140 out-of-pocket monthly medication expenses*

|

|

Weight loss program (ex: Weight Watchers)

Extra cost of healthy convenience foods vs unhealthy convenience choices:

|

$20 - $30 (average co-pay) for additional screenings:

|

|

Prediabetes treatment (ex: YMCA Diabetes Prevention Program)

|

$25 - $40 additional costs for specialized footwear

|

|

Physical Activity gear

|

$20 additional monthly cost for erectile dysfunction

|

* Rodbard H.W, Green A.J, Fox M.C, Grandy S. Impact of type 2 diabetes mellitus on prescription medication burden and out-of-pocket healthcare expenses. Diabetes Research & Clinical Practice 87 (2010):360–365.